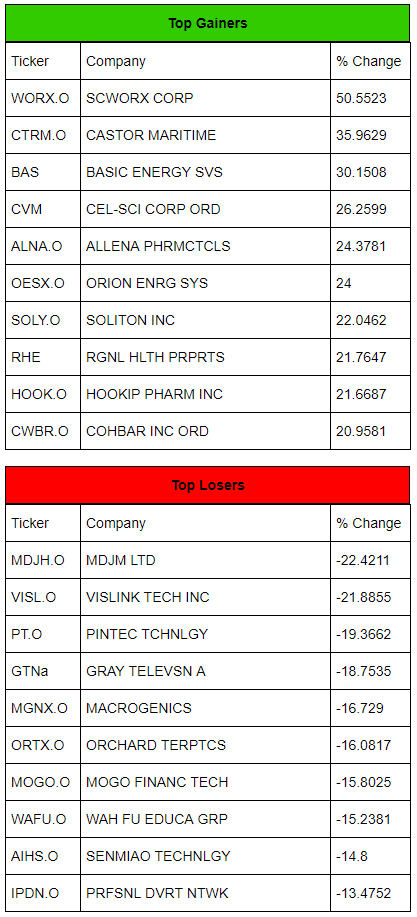

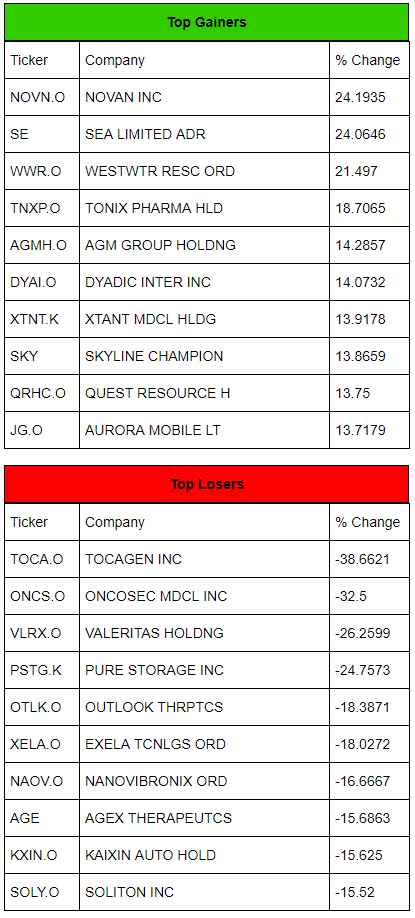

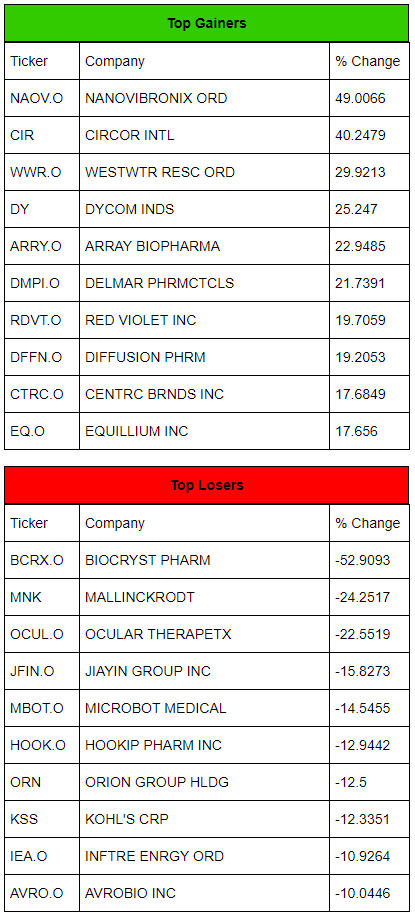

US Markets Top Gainer and Top

Losers

Wednesday, October 23, 2019

Monday, October 21, 2019

Monday, September 30, 2019

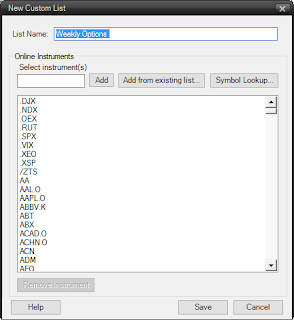

Adding a List of Weekly Options To MetaStock

A frequent question from MetaStock users is how to get a list of weekly options into MetaStock.

I've prepared a Spreadsheet that includes all of the CBOE Weekly Options Symbols. Since I've put all the symbols in the Reuters Instrument Codes, it is ready to be used in MetaStock.

To add these to MetaStock simply follow these simple instructions.

1) Open the spreadsheet file here.

2) Choose the Download option in the upper right hand side of your screen.

3) Open the File when it completes Downloading.

4) Open MetaStock and Click on the Chart option in the PowerConsole.

5) Right Click on the Custom Online Data List as shown in the screen capture below

6) Choose New

7) Type in name for your list under List Name

8) Go back to your spreadsheet and highlight column A by clicking on the column header.

9) Click Ctrl-C to copy the list to your clipboard.

10) Toggle back to your new custom list.

11) Hover your mouse over the blank area and use Ctrl-V to past your clipboard into the new list

It should look like this:

Click on the Save button.

Your new list is available and ready to use!

Thanks for using MetaStock!

Happy Trading.

Friday, August 16, 2019

Thursday, August 8, 2019

Tuesday, July 23, 2019

Monday, July 15, 2019

Friday, July 12, 2019

Tuesday, July 9, 2019

Monday, July 8, 2019

Wednesday, July 3, 2019

Tuesday, July 2, 2019

Friday, June 28, 2019

Thursday, June 27, 2019

Wednesday, June 26, 2019

Tuesday, June 25, 2019

Monday, June 17, 2019

Thursday, June 13, 2019

Tuesday, June 11, 2019

Monday, June 10, 2019

Wednesday, June 5, 2019

Tuesday, June 4, 2019

Monday, June 3, 2019

Tuesday, May 28, 2019

Thursday, May 23, 2019

Wednesday, May 22, 2019

Tuesday, May 21, 2019

Friday, May 17, 2019

Wednesday, May 15, 2019

Tuesday, May 14, 2019

Monday, May 13, 2019

Wednesday, May 8, 2019

Top Gainers and Losers

| Top Gainers |

|---|

| Ticker | Company | % Change |

|---|---|---|

| TVIX.O | CS VEL DLY SH 2X | 32.814 |

| COHU.O | COHU INC | 24.1758 |

| ATAI.O | ATA INC ADR | 22.8261 |

| SEDG.O | SOLAREDGE TEC | 22.6983 |

| ITRI.O | ITRON INC | 21.4326 |

| AKTS.O | AKOUSTIS TECHN | 20.4688 |

| AKRX.O | AKORN | 17.1617 |

| BLIN.O | BRIDGELINE DIGTL | 16.5049 |

| VIIX.O | CS VEL VIX SHORT | 16.3877 |

| EVC | ENTRAVISION COM | 15.5405 |

| Top Losers |

|---|

| Ticker | Company | % Change |

|---|---|---|

| CPRX.O | CATALYST PHRMCLS | -39.6072 |

| BNGOW.O | BIONANO GNMCS WT | -29.789 |

| XENT.O | INTERSECT ENT | -24.2836 |

| MYL.O | MYLAN NV | -23.8146 |

| PAHC.O | PHIBRO ANIMAL HT | -21.3297 |

| TRVI.O | TRVI THERPTC INC | -21.1 |

| NLS | NAUTILUS INC | -19.5076 |

| GLUU.O | GLU MOBILE INC | -18.1818 |

| NM | NAVIOS MARITIME | -16.4882 |

| TXMD.O | THERAPETCSMD ORD | -16.4835 |

Tuesday, February 26, 2019

One of the most active stocks today is trying to break out !!

From the desk of Sagar Nandi @ SuperiorProfit

One of the most active stocks today is a cannabis stock trying to break out of Memory resistance!

CUE 360° analysis summary

$ACB is relatively new stock and its performance may be decided more by its own strength than by anything else. The stock is breaking out of resistance and is outperforming the market. It may give a Go With Flow long setup today which will also be a Breakout long setup.

I am sharing it as a possible technical trade setup. The stock is relatively new. Its performance may be decided more by its own strength than its industry as a whole (unless cannabis related regulatory news is expected that may move all the cannabis stocks as a whole).

All the snapshots are taken around 10:10 AM EST 26th Feb 2019, Tuesday. Numbering in the text below follows the marking on the pictures.

IMPORTANT: As the price may move up or down during the day, you may confirm a swing trade setup at or near market close.

CUE Technical Analysis

One of the most active stocks today is a cannabis stock trying to break out of Memory resistance!

CUE 360° analysis summary

$ACB is relatively new stock and its performance may be decided more by its own strength than by anything else. The stock is breaking out of resistance and is outperforming the market. It may give a Go With Flow long setup today which will also be a Breakout long setup.

I am sharing it as a possible technical trade setup. The stock is relatively new. Its performance may be decided more by its own strength than its industry as a whole (unless cannabis related regulatory news is expected that may move all the cannabis stocks as a whole).

All the snapshots are taken around 10:10 AM EST 26th Feb 2019, Tuesday. Numbering in the text below follows the marking on the pictures.

IMPORTANT: As the price may move up or down during the day, you may confirm a swing trade setup at or near market close.

CUE Technical Analysis

Weekly Backdrop chart template.

1) Weekly Backdrop candle color is bullish (cyan).

Daily Entry chart template.

2) Daily is bullish in terms of Swing indicator (which means the stock is in an uptrend with higher highs and higher lows). The stock is also above the white and yellow Direction lines, confirming the uptrend further.

3) ACB was inside a triangle pattern formed by Resistance and Support Memory trendlines.

4) Today the stock is trying to break out of the triangle pattern, to the upside. Daily Flow candle color is cyan. This is signaling a Go With Flow trend following long trade setup.

5) Relative Performance is sharply tilting up, showing that ACB is outperforming the market.

Miscellaneous.

6) Today ACB has positive news related to the increase in its production capacity.

7) It is also one of the most active stocks today in the USA market as of this time.

1) Weekly Backdrop candle color is bullish (cyan).

Daily Entry chart template.

2) Daily is bullish in terms of Swing indicator (which means the stock is in an uptrend with higher highs and higher lows). The stock is also above the white and yellow Direction lines, confirming the uptrend further.

3) ACB was inside a triangle pattern formed by Resistance and Support Memory trendlines.

4) Today the stock is trying to break out of the triangle pattern, to the upside. Daily Flow candle color is cyan. This is signaling a Go With Flow trend following long trade setup.

5) Relative Performance is sharply tilting up, showing that ACB is outperforming the market.

Miscellaneous.

6) Today ACB has positive news related to the increase in its production capacity.

7) It is also one of the most active stocks today in the USA market as of this time.

Thursday, January 24, 2019

Shortcuts inside of MetaStock

Do you like shortcut keys?

Do you wish you knew MetaStock's shortcut keys?

If you answered yes to either of these questions, then this list is for you:

Shift f1 - Help Mode

Ctrl C - Copy to Clipboard

Ctrl X - Cut to Clipboard

Ctrl V - Past from clipboard

Delete - Delete Selected Item from a chart

Alt + Delete - Delete all items on a chart

Tab Select Next Item

Shift Tab- Select Previous Item

Ctrl Z - Undo last action

Ctrl Y - Redo last action

Alt Right Arrow - Move forward one security

Alt Left Arrow - Move Backward one security

Ctrl Right Arrow - Scroll chart Left

Ctrl Left Arrow - Scroll chart right

Note - You can also use the wheel mouse to scroll left and right.

Ctrl + Zoom In

Ctrl - Zoom out

Note You can use Ctrl and the wheel mouse to zoom in and out.

Ctrl F - Open Forecaster

Ctrl I - Insert Indicator

Crtl O - Open chart file

Ctrl N - Create a new Layout/Composite file

Ctrl S - Save a chart

Ctrl P - Print a chart.

Alt Enter - Display properties of selected items

Ctrl D - Start the Downloader

Ctrl E - Run the Explorer

Ctrl T - Run System Tester

Ctrl R - Run Expert Advisor

Ctrl I - Run Indicator Builder

Ctrl W - Open Power Console

Another thing I find extremely helpful. When you'd like to change securities, simply start typing a new Symbol and hit Enter and it will jump to any new symbols.

Hope its helpful.

Happy Trading,

Jeff Gibby

Director of Sales.

Wednesday, January 16, 2019

Validate your stock news before taking your trade

Validate your stock news before taking your trade

From the desk of Sagar Nandi at Superior Profit

You

read a piece of news about some stocks you know in the newspaper. The paper

seems to make a sensible point about buying the stocks. You rush to your broker

and place your trade to buy those stocks. After all, the news claimed that some

of the largest funds in the world are accumulating the stocks. All you had to

do is to piggyback on them. Right? Wrong.

It

is not the point whether the analysis in the news makes sense or not. It is

about whether the stock meets the buy criteria. Don’t you have a system using

which to buy? Well, then you are going to drain your account down one way or

the other. Be it because of news trading or not. Before thinking of investing

in the next stock, the sensible thing to do will be to acquire a robust and

easy to use a system and learn how to use it.

Once

you have a system, the system should provide you with enough trading

opportunities through meaningful scans. And if you hear about some stocks in

the news, you can use the same system to validate if it is allowing you to buy.

Here

is a real-life example. On 15th January 2019, CNBC published an article titled

“Singapore shares are ‘cheap’ and ‘attractive’ — and major wealth managers say

it’s time to buy”. No doubt the wealth managers disseminated that information

out of a feeling of generosity to help you make a ton of profit. We get that.

Still, as a disciplined trader, we would like to validate the

stocks with our own system. Whatever be the system that we are using. Let me

use the CUE system to look at some of the stocks mentioned in that article.

Three banking stocks: DBS, UOB, and OUB.

Regarding

fundamentals, the article claimed that the stocks are (a) cheap historically

and regionally, (b) good dividend payers. Let me validate that using CUE Vital

stock scorecard which calculates scorecard across various dimensions including

valuation, growth, dividend, etc. Reading from the attached snapshot of CUE

Vital:

(1)

None of the stocks has an optimal valuation. They are all overvalued, and that

is shown by the Valuation score being in magenta color.

(2)

All the stocks pay a decent dividend. That is a valid reason to look for buying

opportunities in these stocks.

(3)

Though the valuation is not optimal as per Vital calculation, all the three

stocks have reasonable earnings growth in recent quarters. That shows the

stocks are improving their performance and that can be one reason to consider

buying these stocks.

That

was our fundamental analysis. What about the stocks being cheap relative to

their history? We use CUE Pendulum chart (that shows price extremes using color

codes) to see if the stocks are at a historically low price. Here is that chart

for DBS. Red or magenta candles show historically low prices. And you will

start to look for buying opportunities when a stock begins to move up from

there. Using that technique, you would begin to look for buying opportunities

in DBS in the 23-23.5 price range. It has gone up from there; not very far, but

has gone up.

Could

you buy the stock decisively in the last few days or weeks? Yes, you could.

Using CUE At A Glance weekly-daily templates that shows unambiguous

checklist-based trade-setups, you could buy DBS on 4th Jan 2019 as it was

bouncing up from the Memory support trendlines in daily and weekly both.

(1)

The daily chart displayed a Bull Release signal as the stock went up from

Watermark pivot support as well as Memory trendline support.

(2)

The weekly had Memory support at the same price level.

(3)

The weekly had displayed the unique CUE Headwind possible reversal signal a few

weeks earlier. That effectively could catch the very low of the stock.

The

news report mentioned the stocks on 15th Jan. As per our above objective

analysis, that was a bit late to buy the stock. From CUE buy signal day of 4th

Jan to the news date of 15th Jan, the stock had gone up by 7.4%. And as of 15th

Jan, there was no low-risk entry opportunity in the stock.

You

may keep an eye on the DBS stock for the next low-risk buy opportunity. What is

the low-risk buy point? A point where the stop-loss is not far away from your

entry price. Such low-risk buy points are handy as you can quickly exit your

trade with a small loss if the stock goes down instead of going up after you

enter the trade. Yes, as unfortunate as it may sound, sometimes the stock will

fall after you buy it. And you need to protect your capital by exiting the trade

with a small loss. The small and first loss is your best loss and is, in fact,

a friend of yours.

One

last thing. Before buying any of the banking stocks in Singapore, you would

also check that the industry is strong relative to others. As of today 16th Jan

2019, using CUE Edge real-time industry rotation analysis, we see that the

Diversified Bank industry (DBS

belongs to this industry) is indeed strong.

(1)

The five days (5D) score of the Diversified Banks industry is in cyan, showing

it is strong relative to other industries. Looking to the right you can see

that it has been cyan for a while. That means the best time to buy DBS bank

(buy at the bottom) might have passed.

Overall

conclusion based on CUE 360° analysis where you can combine the edges of

industry strength, fundamental strength, and technical strength before buying a

stock, DBS is a robust fundamental stock concerning growth, and it has a decent

dividend. Its industry is also strong. Technically the stock is strong but not

at a low-risk buy point. You may wait to have a low-risk buy point on technical

charts and carry out the 360° analysis at that time to ensure all the

industry-fundamental-technical forces are aligned in your favor before buying

the stock.

That

was my analysis using the CUE systems that I use for my trading. You may use

CUE systems standalone or combine its powerful 360° analysis with other

techniques. Whatever be your approach, I strongly suggest you check out any

news-based stock using your system and only buy if that tells you to buy.

Subscribe to:

Posts (Atom)